Advantages for Women Buyers in Indian Real Estate

With a view to promote ownership of property among females, the Government of India has initiated several measures so that purchasing premium apartments for sale becomes more profitable. Given below are the monetary benefits that female home buyers can look forward to if they buy 3 BHK or 2 BHK flats for sale and register a property.

Lower stamp duty for women

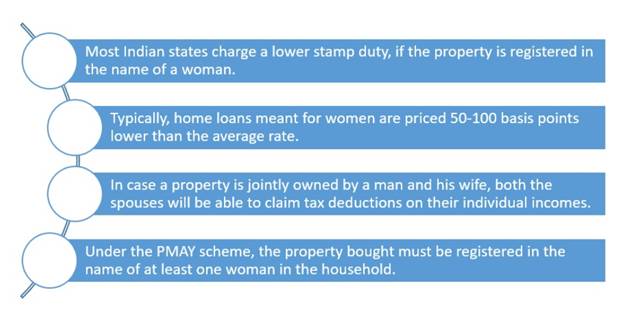

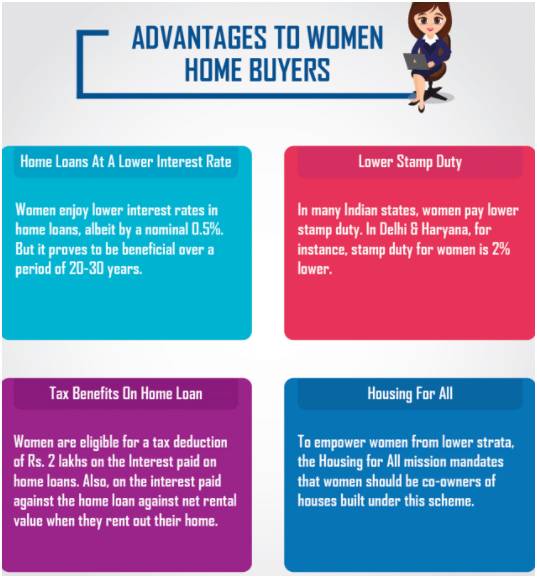

In most Indian states, the registration charges for purchasing a propertyhave been lowered for women. In other words, if a woman registers a property in her name, she has to pay less stamp duty compared to men. For example, in Delhi, male buyers pay 6% of the total property value as stamp duty, whereas women buyers have to pay only 4%. Some states like Jammu have gone further by completely waiving stamp duty on property bought by women.

On 8th March 2021, the Government of Maharashtra declared a 1% concession to home buyers who are women as compared to male home buyers. Male home buyers now need to pay 3% stamp duty, but female buyers have to pay only 2% on the condition that property is bought within January 1 of 2021 to March 31 of 2021.

In Uttar Pradesh, if a woman buys a property up to Rs.10 lakhs, she can avail of 1% concession in stamp duty charges on premium apartments for sale. But there is no concession if the property value is above Rs.10 lakhs.

In Himachal Pradesh, if the property is registered in the name of a woman, the authorities collect 4% stamp duty, if the owner is a man, then 6%, and if the owners are both a man and a woman jointly, then the stamp duty is 5%.

Also read: Investment in Residential Property

Home loan interest rates

A large number of homebuyers in India rely on home loans to buy their dream homes. By taking help from such a credit facility, consumers purchase properties at a young age. Several banks charge them much lower interest rates than males. Generally, home loans that are meant for the female population are priced about fifty to hundred basis points less than the average rate. (One hundred basis points is equal to one percentage point.)

State Bank of India, the country's biggest lender, charges 6.80% interest as compared to 7% for a male buyer, for home loans up to Rs 30 lakhs. HDFC offers home loans to women at 6.90% interest while men are charged a slightly higher interest rate per annum.

Increased home loan eligibility

A practical and effective way to buy one's dream house is by taking a home loan. But before finalising the home loan on any property, home loan providers like NBFCs and banks, etc. evaluate the eligibility of any home loan seeker, which solely depends on his or her salary. If a person wants to co-own a house with his wife, it increases the loan amount, as dual-income is taken into consideration.

Tax benefits on home loan

Males and females are entitled to a deduction in tax on interest up to Rs 2 lakh on a loan obtained for either purchase or construction of a home. If a property is owned jointly by a married working couple, then both of them can separately claim tax deductions. However, if someone buys a home under Rs.45 lacs in the period April 2019-March 2020, an additional deduction of up to Rs. 1.5 lacs can also be sought under the newly implemented 80EEA Act.

Benefits under PMAY

Female Home Buyers have been given special consideration under the PradhanMantriAwasYojana (PMAY), too. A female home buyer can apply for a home loan or a PMAY subsidy irrespective of her marital status. The program doesn't differentiate betweenmarried and unmarried female buyer. PMAY guidelines make it necessary to have at least one female family member registered as the house's co-owner. In cases where a woman solely holds the ownership of the property, the Govt. provides a special subsidy of a maximum of Rs 2.67 lakh.

Many female buyers are interested in premium flats in Bachupally because of easy access to IT hubs. The premium apartments for sale there include 2 BHK flats for sale as well as 3 BHK flats for sale.

For more details Contact Us