How to Maximize Tax Savings on Real Estate Investments

Investing in real estate in India, is a great way to build your wealth and gain financial freedom. Real estate is famous for good returns in less time and is a considered a safe option for investment provided that one is aware of the developments in the field of real estate, which the trusted companies are and knowing the right amount is for investing. It has been seen that the real estate investors face trouble as most of them are not aware ofabout the taxes involved, especially the Long Term Capital Gain (LTCG) tax and the relaxations that government gives to a real estate investor.

A large number of tax-saving windows for property purchase are offered by the Income Tax Act of India. Being able to receive loans can largely allow for a significant tax saving purpose and allow for a smoother cash flow in the long run. Residential real estate is often prioritised with due exemptions offered on the same in regards to tax laws which can be a little confusing, so mentioned below is a simpler breakdown for a better understanding.

Tax Laws

80C – One can claim tax benefits under this section on repaying the principal amount. Deductions can also be claimed on investments that are made in the return of any generated income, provided this income is made within the same year of investment made. The maxim0um tax saving limit under this section is Rs. 1,50,000.00

24B – Under this section, one can claim exemptions on the payable interest only for home loans. The maximum tax saving for a self-occupied property is Rs. 2,00,000.00 In case the property is still under construction until five years from the time the loan was taken, this benefit shall be reduced to Rs. 3,00,000.00

80EE – This section takes care of income tax rebates on residential property loans for all first-time buyers. A deduction of Rs. 5,00,000.00 as well as an additional tax deduction of Rs. 2,00,000.00 is allowed here. Until the entire home loan is paid, this facility can be availed.

Additional Tax Benefits on Residential Real Estate Investments

No one likes paying large chunks of their earnings towards taxes and minimising those costs are always welcomed. Stated below are some of the tax-saving options for people looking to purchase flats that are available for sale.

1. Long Term Capital Gains

Long term capital gains (LTCG) have seen a structural change in tax benefits for those who are selling a house to buy another one. The rollover benefit of capital gains under section 54 of the Income Tax Act is subsequently increased from investment in one house to two houses. This is offered to only those people who have capital gains of up to Rs. 2 crores and can only be availed once in a lifetime.

2. Tax Savings for Ready to Move in Homes

The benefits for these types of homes are only allowed after a certificate of completion has been received by the taxpayer. Tax saving options for such properties which are complete in their entirety and ready to be taken possession of immediately are covered under sections 80C, 80EE and 24B of the Income Tax Act of India.

3. Short Term Capital Gains

Just like in long term capital gains, one can claim capital gain on income taxes under this as well. Since short-term is considered within an ordinary income bracket, the tax savings are highlydependent on that.

4. For Self Occupying Owners of 2 Properties

People who declare that they own two houses and are both self-occupied are offered considerable relief from tax payments. Early on, despite owning two homes, owners were only allowed to announce one of them as the self-occupied one which would increase tax payments on rent in case of subletting. Now, due to the allowance of this option, owners of two homes will not need to pay two separate taxes on their homes and can only pay for one.

5. Depreciation

Depreciation is considered one of the most powerful tax-saving benefits of all in the world of real estate investment. This is typically the largest tax-saving option available to investors and heavily helps increase and improve their cash flow due to the reduction of tax liabilities.

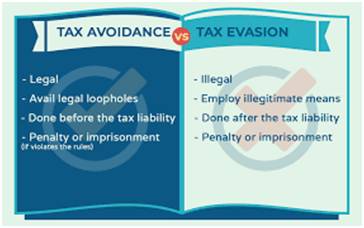

Tax savings, not tax evasion

Tax has always been something that every person wants to minimise if not avoid, as it creates a lot of pressure on the finances of a person but people must keep in mind that they pay taxes for the benefit of the nation where they live, and at the same time they must be smart enough to ensure that they pay the minimum amount they owe in legal circumstances. Maximising tax savings is an art that involves a fine line between legal and illegal activities, so one must ensure that while making investments and while consulting experts on the matter of tax savings they aren’t conducting any illegal activities that may involve tax evasion rather than savings.

Also read: Getting Home Loan from Reputed Builder