10 Important Tips to Consider Before Taking a Home Loan

Owning a residential property is an asset but also one of the most pertinent financial decisions people take in their lives. Be it for investment purposes or to self occupy, the banking sector offers a variety of loans that are both lucrative as well as beneficial. First-timers can often be daunted by factors such as interest rates, credit scores, additional fees, and many others.

When you have found your dream home, especially one that is as luxurious and affordable such as PraneethPranav Leaf in Mallampet, it is hard to say no. Spread over 30 acres with 502 spacious and opulent villas, this is one of the most spectacular residential properties in the city of Hyderabad. Since it is one of the upcoming industrial and educational hubs of the city, buying flats for sale in Kphb will motivate you to opt for a much-needed home loan.

Despite making an informed decision regarding the purchase of your property with the aid of a loan, you will need to research and understand a few tips before you go ahead. Ten important points to consider before taking a home loan are stated below

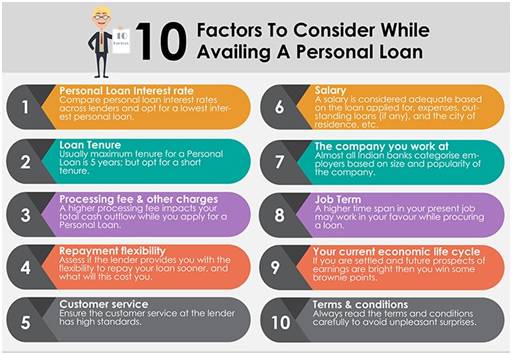

1. Credit Score

As an aspiring loan seeker, you should ensure that you have a good credit score because that is the first thing banks will take a look at before granting a loan.This is not difficult if you don't have outstanding payments of current loans, credit card bills, investment instalments, etc. Undisputed and owned assets can also be considered as collateral against home loans.

2. Thorough Research

Due to the plethora of home loans available in the market, ensure that you do detailed research on each of them for yourself and make an informed decision. Factors such as EMI's, interest rates, down payment, etc., are important to make a note of to ensure smoothness of transactions.

3. Eligibility

Ensure that you check your eligibility before applying for the loan, so you don't face unnecessary glitches during the process. Your credit history will play an important role in determining your eligibility.

4. Processing Fees

Once the bank has accepted the home loan application, processing fees are charged for the same. This amount differs from bank to bank, and the fee is usually up to 1% of the amount that they disburse. Check the lower fees to ensure you get value for your money, and go on and purchase the flats for sale in the financial district.

5. Convenient EMI’s

Equated monthly instalments are the amounts you choose to pay in the most convenient instalment option. Various banks offer different EMI's which are catered to suit the different requirements of the borrowers.

6. Tenure

The time taken to pay off a sanctioned loan is defined as the repayment tenure. This goes in plumb with the EMI’s and increases the interest rate that applies to you if opted for in a longer period. Depending on your income, it is best to take the shortest tenure period to ensure optimum money saving.

7. Additional Charges

Banks charge fees in addition to the loan payment interests. These fees are different for different banks, and you should do your research to ensure you are getting charged at your convenience.

8. Foreclosure Norms

Making the repayment of the balance amount before the completion of the tenure of your home loan is termed as foreclosure. The faster this is paid off, the lesser interest you are liable to pay. A penalty could be charged by banks in some cases when this option is chosen, so clarify this before you embark on the processing of your loan when looking to buy flats in Bhel.

9. Check the Documents

All the terms and clauses of the home loan are mentioned in the forms and documents at the time of processing. These need to be thoroughly read and understood before you go ahead and make any signatures, thereby binding yourself in the contract.

10. Down Payment

While availing of any home loan, you would be required to pay around 10% - 15% of the total amount. This is called the down payment. The balance amount is converted to EMI's as per your choice, which can be paid monthly. In case you have additional money, you can choose to pay a larger down payment and reduce interest charges.

When you decide to purchase flats for sale in Miyapur with the help of a home loan, it is imperative that you understand and carefully know what that loan entails. With stunning villas such as in PraneethPranav Leaf, you will be tempted to immerse yourself in the world of residential bliss. So get in touch with Praneeth Group and make your dream a reality!

Also read: Vastu Tips